Econ fin

CorpFin - ASM 1

Table of Contents

expand_more expand_lessDETAILED INSTRUCTION

A/ ASSIGNMENT RECAP

● Create a detailed report, including MS-Excel worksheets, on budget planning for retirement. Assume a scenario where you're 22 years old, working in finance, living in a one-bedroom apartment, and plan to retire at 60. Research and realistically estimate your salary, living expenses, interest rates, etc.

● Explain how your attitude towards risk and personal characteristics (age, gender, education, work, family) influence your investment plans and outcomes.

● Estimate and analyze how economic, political, and other significant global events could affect your investment plans. Provide supporting data with academic research, graphs, and illustrations

Structure:

1. Financial Assumptions & Background (Suggested 100-150 words)

2. Living Expenses Analysis (Suggested 200-250 words )

3. Retirement Income Needs (Suggested 50-100 words)

4. Accumulated Retirement Funds (Suggested 50-100 words)

5. Investment Strategy & Asset Allocation (Suggested 100-150 words)

6. Risk Tolerance & Investment Behavior (Suggested 400-450 words)

7. Economic & Global Event Impact (Suggested 400-450 words)

B/ KEYWORD EXPLANATIONS

1. Budgeting

A financial planning process where individuals or businesses estimate their expected incomes and expenditures over a certain period. This helps in making informed decisions about spending, saving, and investing.

2. Net Present Value

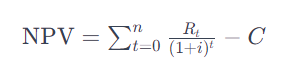

Net Present Value (NPV) is a financial metric used in capital budgeting to analyze the profitability of an investment or project. It calculates the difference between the present value of cash inflows and the present value of cash outflows over a period of time. The formula for NPV is:

where Rt is the net cash inflow during the period t, i is the discount rate, and C is the initial investment.

A positive NPV indicates that the projected earnings (in present dollars) exceed the anticipated costs, suggesting that the investment is likely to be profitable.

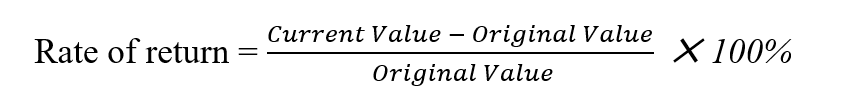

3. Rate of Return

The gain or loss on an investment over a period, expressed as a percentage of the investment's initial cost. The formula is

4. Weighted Average Rate of Return

n: Calculates the overall rate of return of a portfolio, considering the different weights of each asset. Formula:

WARR = ∑ (Weight of Asset × Return of Asset)

5. Discount Rate

In DCF analysis, this is the interest rate used to convert future cash flows into present value.

6. Corporate Bonds

These are debt securities issued by corporations to raise capital. Investors lend money to the corporation in exchange for interest payments over a set period. At maturity, the face value of the bond is repaid. They typically offer higher yields compared to government bonds due to higher risk.

7. Government Bond

Issued by national governments, these bonds often have a fixed interest rate and are considered low-risk investments. Governments use them to raise money for various public projects. The return is usually lower than corporate bonds, reflecting their lower risk.

8. Treasury Bills (T-Bills)

Short-term government debt securities with maturities ranging from a few days to 52 weeks. T-bills are sold at a discount from their face value, and the investor receives the full face value at maturity. They are considered one of the safest investments as they are backed by the government.

9. Large-cap equity

Stocks of large companies, often valued at more than $10 billion. These stocks are generally considered more stable and less risky than smaller-cap stocks. No specific formula; valuation is based on market capitalization.

10. Small-cap Equity

Stocks of smaller companies, typically with market capitalizations between $300 million and $2 billion. These stocks can offer high growth potential but carry more risk. Valuation is market cap-based.

11. International Equity

Investments in stocks of non-domestic companies. Diversifies the portfolio and potentially reduces risk through geographical spread. No specific formula as it depends on individual stock performance.

D/ DETAILED OUTLINE

1. Financial Assumptions & Background

- Outline the fundamental assumptions for your financial analysis, such as current age and retirement timeline, housing and marital status, income source, and any other economic or financial assumptions such as income growth or inflation rate.

Examples:

This retirement strategy is built on key assumptions to shape a viable plan.

Starting at 22 years old, it envisions retirement at 60. Early on, I live in a one-bedroom apartment, mortgage-free. The strategy foresees a marital shift at 30, followed by starting a family with one child at 31.

Employment is the main income source, complemented by earnings from a savings and investment account, including interest and dividends.

Economic parameters include a rising salary from 20 to 100 million VND by age 60, a 3.4% yearly inflation rate, and a 4.8% annual interest rate, reflecting moderate inflation and a steady job market.

Charge your account to get a detailed instruction for the assignment