Business Foundation

Understanding Business Environment - Sem C - Vietnam Case

Vietnam Inflation Analysis

Table of Contents

expand_more expand_lessTable of Contents

DETAILED INSTRUCTION

● Length: Length: 1,500 words total (excluding references, graphs/charts, and tables)

The Task: This assessment focuses on a detailed analysis of a specific country's management of inflation over the past 15 years, analyzes the effectiveness of policies and strategies implemented by a country's government or central bank in managing inflation and maintaining price stability, focusing on their impact on businesses.

The country: Japan, Burma, South Korea, Cambodia, Indonesia, Malaysia, Philippines, China, Vietnam, Thailand

Suggested structure:

1. Introduction

2. Background of Inflation in the country

3. Inflation's Impact on the country's Economy and Businesses

4. Policies and Strategies for Inflation Management

5. Evaluation of Policy Effectiveness

6. Lessons and Recommendations

7. Conclusion

● Inflation: The rate at which the general level of prices for goods and services is rising, and, subsequently, the purchasing power of currency is falling. Central banks attempt to limit inflation, and avoid deflation, in order to keep the economy running smoothly.

● Consumer Price Index (CPI): A measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is commonly used as a measure of inflation.

● Monetary Policy: The policy adopted by the monetary authority of a country, like the central bank, to control the supply of money, availability of money, and cost of money or rate of interest, in order to achieve a set of objectives oriented towards the growth and stability of the economy.

● Fiscal Policy: The use of government spending and tax policies to influence economic conditions, including demand for goods and services, employment, inflation, and economic growth.

● Interest Rates: The amount charged, expressed as a percentage of principal, by a lender to a borrower for the use of assets. Interest rates are typically noted on an annual basis, known as the annual percentage rate (APR).

● Macroeconomic Stability: Refers to a state in which an economy's major indicators, like inflation rates, growth rates, and unemployment rates, are in balance and are not subject to extreme fluctuations.

● Purchasing Power: The value of a currency expressed in terms of the amount of goods or services that one unit of money can buy. Inflation reduces the purchasing power of money.

● Business Stability: A condition where businesses in a country are able to grow or remain healthy, without extreme fluctuations in profits, sales, or business operations, often influenced by the country’s economic policies and conditions.

● Quantitative Easing: A monetary policy wherein a central bank buys predetermined amounts of government bonds or other financial assets in order to inject money into the economy to expand economic activity.

● Supply-Side Policies: Economic policies designed to stimulate the economy by increasing production. This could involve reducing business taxes and regulations, and promoting technological innovation.

C/ REFERENCE

II. Background of Inflation in the Country

LAM PHÁT Ở VIỆT NAM GIAI ĐOẠN 2007-2017: DIỄN BIẾN, NHÂN TÔI TÁC ĐỘNG VÀ DỰ BÁO

Vietnam’s 2022 inflation reaches 3.15%: stats office | Tuoi Tre News

III. Inflation's Impact on the Country's Economy and Businesses

IV. Policies and Strategies for Inflation Management

V. Evaluation of Policy Effectiveness

VI. Lessons and Recommendations

D/ DETAILED OUTLINE

I. Introduction (Approx. 100-150 words)

|

Theory: A) Impact on the company’s operation ● Cost Management: ○ Inflation affects the cost of goods and services, including raw materials, labor, and other operational expenses. ○ Business managers need to anticipate and adjust for rising costs to maintain profitability and competitiveness. ● Pricing Strategies: ○ Inflation influences consumer purchasing power, and businesses may need to adjust their pricing strategies to reflect changing economic conditions ○ Managers must consider how price increases or adjustments will impact customer demand and market share. ● Investment Decisions: ○ Inflation affects the return on investments. Real returns need to be considered after adjusting for inflation. ○ Business managers need to carefully evaluate investment opportunities, factoring in inflation to make informed decisions.

B) Impact on the country’s economy ● Interest Rates and Borrowing Costs: ○ Inflation is closely linked to interest rates. Central banks may adjust interest rates to control inflation. ○ Business managers need to consider the impact of changing interest rates on borrowing costs, which can affect investment decisions and capital expenditures. ● Government Regulations and Taxation: ○ Inflation can influence government policies, regulations, and tax rates. ○ Business managers should stay informed about changes in these areas to adapt their strategies and remain compliant. |

Example for Vietnam: Select 1 to 2 elements in section A and 1 element in section B

Inflation, a ubiquitous yet intricate facet of economics, plays a pivotal role in shaping the landscape in which businesses operate. Particularly for Vietnam, a rapidly evolving economy, understanding inflation trends is not merely beneficial but essential for business managers. This necessity stems from the profound impact that inflation has on various economic variables such as cost of inputs, pricing strategies, consumer purchasing power, and ultimately, the profitability and sustainability of businesses. In a country like Vietnam, where economic dynamics are swiftly changing, being adept at interpreting and anticipating inflation trends can afford businesses a significant competitive edge.

● Introduce the scope and aim of the paper.

Example:

This report analyzes Vietnam's approach to managing inflation over the past 15 years, focusing on the impact on businesses and economic stability. It examines the government and central bank's strategies for controlling inflation and maintaining price stability. By assessing the effectiveness of these policies, the report aims to offer insights into Vietnam's inflation management and its implications for business strategy and decision-making in an evolving economic landscape.

II. Background of Inflation in the Country (Approx. 150-200 words)

Requirement: Provide a historical perspective of inflation over the past 15 years, including major fluctuations and events

|

1, Inflation Rates: ● Provide an overview of the annual inflation rates over the past 15 years. ● Highlight periods of high or low inflation and identify any significant trends. 2, Economic Indicators: ● GDP growth: ○ Positive Correlation: Generally, a growing economy with a higher GDP tends to experience higher levels of inflation. Increased economic activity leads to higher demand for goods and services, contributing to upward price pressures. ○ Negative Correlation during Recessions: Conversely, during economic recessions, a decline in GDP growth can result in lower demand, leading to deflationary pressures. Central banks may respond by implementing expansionary monetary policies to stimulate economic activity and prevent deflation. ● Unemployment rates: ○ Inverse Relationship: Unemployment and inflation often exhibit an inverse relationship, known as the Vietnams curve. As unemployment decreases, labor markets tighten, leading to higher wage demands. Increased labor costs can contribute to higher production costs for businesses, potentially leading to inflation. ○ Full Employment and Wage-Price Spiral: At full employment, further reductions in unemployment may trigger a wage-price spiral. Higher wages lead to increased consumer spending, which, in turn, drives up demand for goods and services, potentially fueling inflation. ● Interest rates: ○ Interest Rates as a Tool: Central banks use interest rates as a primary tool to control inflation. In periods of high inflation, central banks may raise interest rates to cool down economic activity and reduce inflationary pressures. Conversely, during economic downturns, central banks may lower interest rates to stimulate borrowing, spending, and investment. ○ Influence on Consumer Spending and Business Investment: Changes in interest rates impact consumer spending and business investment decisions. Higher interest rates can deter borrowing and spending, reducing overall demand and inflationary pressures. Lower interest rates, on the other hand, encourage borrowing and spending, potentially boosting inflation. 3, Global Events: ● Consider major global events that may have affected the country's economy, such as financial crises, geopolitical events, or natural disasters. Assess how these events influenced inflation rates. COVID-19 Pandemic: ● Demand and Supply Disruptions: Lockdowns, restrictions, and disruptions to global supply chains during the pandemic led to both demand and supply shocks. Reduced consumer spending and disruptions in production affected demand for goods and services, contributing to deflationary pressures. Simultaneously, supply chain interruptions led to shortages and increased production costs for certain goods. ● Government Stimulus and Inflationary Pressures: Many governments responded to the economic fallout by implementing large-scale fiscal stimulus measures. Increased government spending and monetary policies, such as quantitative easing, injected money into the economy, potentially leading to inflationary pressures. ● Sectoral Variances: Different sectors experienced varying impacts. Industries directly affected by lockdowns, such as travel and hospitality, faced decreased demand and deflationary pressures, while others, like e-commerce and technology, saw increased demand and potential inflationary effects. Regional Conflict: ● Supply Chain Disruptions: Regional conflicts can disrupt supply chains, leading to shortages and increased production costs for affected goods. This can result in inflationary pressures as businesses face higher costs for inputs. ● Geopolitical Tensions and Energy Prices: Regional conflicts often impact global energy markets. Geopolitical tensions can lead to fluctuations in oil prices, affecting transportation costs and the prices of various goods and services. Higher energy prices can contribute to inflation. ● Uncertainty and Investment: Regional conflicts create uncertainty, affecting business and consumer confidence. In such environments, businesses may delay investments, impacting economic activity. |

Guideline for Vietnam:

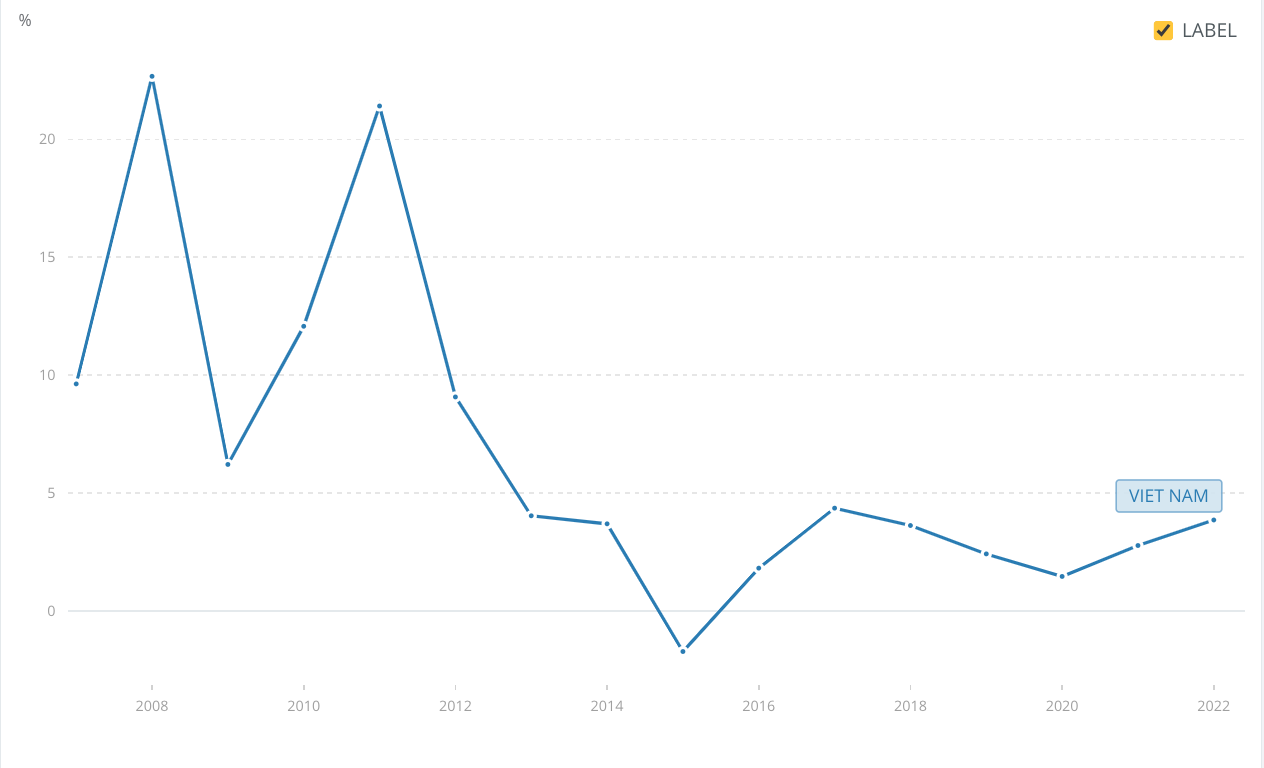

From 2007 to 2011, Vietnam experienced a significant and unpredictable rise in inflation, with rates jumping from single digits to double digits, reaching 23.1% in 2008 and 18.7% in 2011. This inflation surge was partly due to Vietnam's need to mobilize external funds for business activities, leading to a high credit growth. This in turn increased the total money supply (M2), contributing to the inflationary trend during this period. (Hoang Thanh Tung, 2019)

The period from 2012 to 2017 in Vietnam marked a phase of maintaining low and stable inflation, a significant contrast to the high rates experienced in previous years. Inflation dropped from a peak of 23.1% in 2008 to 9.1% in 2012, further reducing to 6.6% in 2013, 4.1% in 2014, and reaching a low of 0.6% in 2015. The trend continued with rates of 4.74% in 2016 and 3.53% in 2017, indicating a successful period of inflation control in over a decade. (Hoang Thanh Tung, 2019)

From 2017 to 2022, Vietnam's inflation rates demonstrated a pattern of stability with some fluctuations, reflecting the interplay of domestic policies and global economic conditions. The inflation rate in 2017 was 3.53%, showing economic steadiness. In 2018, it slightly increased to 3.54%, then dipped to 2.80% in 2019. The year 2020 saw a minor rise to 3.22%, likely influenced by the global economic impact of the COVID-19 pandemic. However, in 2021, inflation significantly dropped to 1.83%, indicating effective economic management. (Tuổi Trẻ, 2022)

Figure 1: Inflation rate in Vietnam in the period 2007 - 2022 (The World Bank)

Charge your account to get a detailed instruction for the assignment